Financial Instruments in Dubai, UAE | Trade Finance Company International

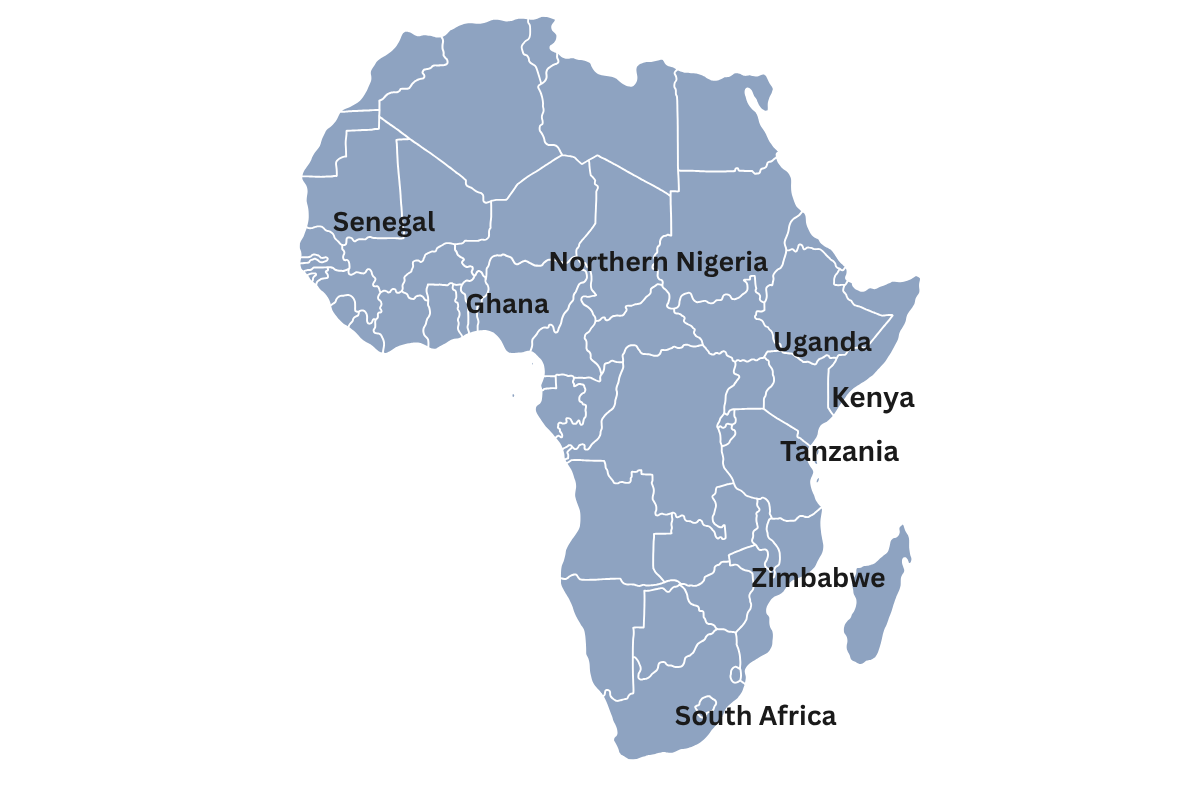

Empowering Ghanaian Businesses with Trusted Trade Finance Solutions

Unlock international trade opportunities with our world-class financial instruments and investment services tailored for Africa’s growing economy.

Global Financial Instruments Hub in Dubai, UAE

Trade Finance Company International in Dubai stands at the center of global commerce, offering advanced financial instruments that support international trade, investment structures, and large-scale project financing. As one of the world’s most trusted financial gateways, Dubai provides unmatched access to global banks, multinational corporations, investors, and cross-border trade corridors.

Our Dubai operations support clients across the Middle East, Africa, Europe, Asia, and the Americas, delivering reliable solutions such as letter of credit, standby letters of credit, bank guarantee, performance bond, advance payment bond, proof of funds, blocked funds, invoice financing, and trade credit. These financial instruments are structured to meet international banking standards while ensuring speed, security, and compliance.

Comprehensive Trade Finance Services in Dubai

We provide a full suite of financial solutions tailored to businesses operating from or through Dubai:

Bank-guaranteed payment for international trade that ensures sellers get paid and buyers receive goods—the gold standard for secure cross-border transactions.

Cost-effective payment backup that replaces cash deposits and guarantees obligations without expecting to be drawn—your safety net for business deals.

Irrevocable bank commitments via MT760 that multiply your financial capacity and serve as cash-equivalent collateral for major transactions.

Bank-backed bonds that prove your ability to deliver on contracts, winning you more tenders and building instant client trust.

Enables you to receive 15-30% upfront payment while protecting your buyer's advance—unlocking immediate cash flow for production.

Same-day bank verification of your financial capacity that fast-tracks negotiations and qualifies you for exclusive opportunities.

Verified restriction of funds in your name that demonstrates commitment and financial capacity without transferring ownership.

Soft Bank confirmation of your financial standing that opens doors to negotiations without creating legal obligations.

The ultimate bank confirmation combines proof of funds with transaction commitment and authority—showing you're serious and ready to close.

Mandatory bid bonds for government and corporate tenders that qualify you to compete for major contracts worth millions.

Other Services

Open secure personal and corporate bank accounts in Dubai through a fully remote eKYC process — no physical presence required.

Access high-yield investment programs and strategic joint venture opportunities designed to grow capital and expand global ventures.

Enhance your business cash flow with flexible loan solutions and invoice financing tailored for importers, exporters, and SMEs.

Empowering importers with extended payment terms and trade credit facilities for purchasing goods from verified Chinese suppliers.

Why Dubai Is the Ideal Location for Financial Instruments

Dubai is globally recognized as a premier financial and trade hub due to:

- Its strategic location connecting East and West

- A strong, well-regulated banking ecosystem

- Investor-friendly business policies

- Free zones supporting international trade and finance

- Access to multi-currency banking and global correspondent banks

Through our Dubai office, clients benefit from financial instruments that are widely accepted by international banks, government entities, suppliers, and institutional investors. Whether you are securing a large import contract, bidding on an infrastructure project, or proving capital capability for an investment, our Dubai-based solutions provide unmatched credibility.

Localized Support for Dubai-Based & International Clients

- International traders operating through UAE free zones

- Middle East contractors requiring performance bonds and bid bonds

- Investors needing verified proof of funds or blocked funds

- Businesses opening offshore and onshore accounts via Dubai eKYC

- Importers using trade credit and supplier financing for China and Asia

Our local presence ensures faster turnaround times, direct coordination with financial institutions, and hands-on transaction support throughout the lifecycle of each deal.

Community & Global Trade Connections

Dubai is home to a vibrant business community spanning logistics, energy, construction, commodities, technology, and real estate. Trade Finance Company International works closely with:

- International brokers and consultants

- Trade facilitators and legal advisors

- Project developers and private investors

- Import-export firms across multiple industries

By aligning with Dubai’s dynamic trade ecosystem, we help clients unlock investment opportunities, secure funding structures, and execute transactions with confidence.

Client Testimonials – Dubai

“The proof of funds issued through Trade Finance Company International Dubai was accepted immediately by our banking counterpart. Their process was professional, fast, and transparent.”

“We successfully opened a business bank account remotely through their Dubai eKYC process. Smooth and efficient from start to finish.”

Emergency & Transaction Security Advisory

All financial instruments issued or arranged through our Dubai office follow strict AML, KYC, and international compliance protocols. Clients requiring urgent verification or time-sensitive documentation may access priority processing upon request.

Frequently Asked Questions

Yes. Our Dubai-structured financial instruments are designed to meet international banking and compliance standards and are widely accepted by banks, suppliers, and institutional counterparties.

Yes. We assist with remote opening of personal and business bank accounts through Dubai’s eKYC-enabled banking channels, subject to compliance review.

Processing timelines typically range from 3–7 banking days depending on documentation, transaction size, and compliance requirements.

Yes. We structure supplier credit facilities and trade credit solutions for clients sourcing goods from China and other Asian markets.

Why Work With Trade Finance Company International – Dubai

Partnering with Trade Finance Company International in Dubai gives you direct access to one of the world’s most powerful financial gateways. Our expertise in structuring secure financial instruments, combined with Dubai’s global banking reach, allows your business to operate with confidence, credibility, and speed. Whether you are expanding internationally, securing large contracts, or validating investment capacity, our Dubai team delivers compliant, efficient, and results-driven solutions that move your business forward.