Trade Finance Company International – Ghana

Empowering Ghanaian Businesses with Trusted Trade Finance Solutions

Unlock international trade opportunities with our world-class financial instruments and investment services tailored for Africa’s growing economy.

Welcome to Our Accra Office

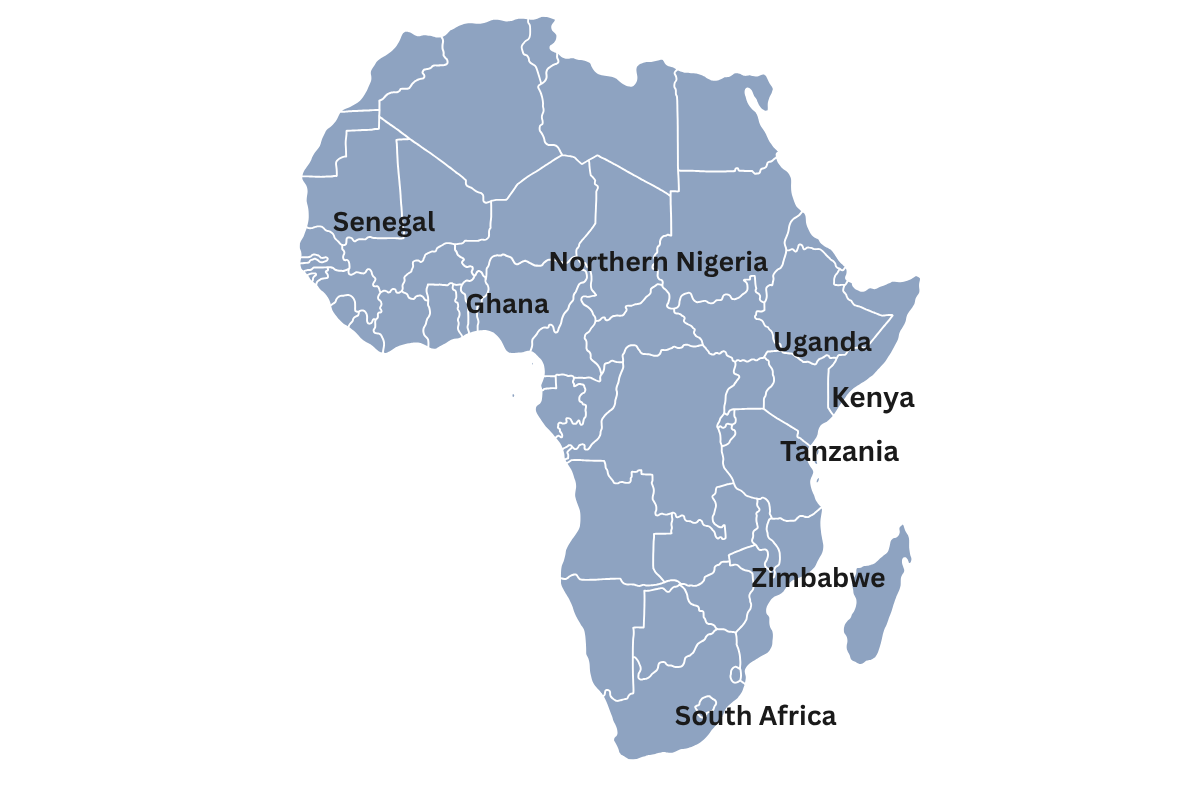

Situated in the heart of West Africa, our Ghana office serves as a regional hub for trade finance, investment, and international business facilitation. With the country’s increasing role in commodities, infrastructure, and export trade, TFCI provides reliable financial instruments such as letters of credit, bank guarantees, and standby letters of credit (SBLCs) — helping businesses in Ghana engage confidently with global partners.

Building Confidence in Global Transactions

Our Accra-based team provides customized solutions including performance bonds, advance payment bonds, proof of funds, and blocked funds, ensuring that your contracts, imports, or tenders are fully secured and compliant.

Trade, Invest, and Grow with Confidence

We also issue bank comfort letters, RWA letters, and bid bonds, vital for companies seeking to participate in major public and private tenders. Additionally, TFCI supports clients with invoice financing, supplier credit, and joint venture investments for infrastructure, commodities, and energy sectors.

Our List of Services

Bank-guaranteed payment for international trade that ensures sellers get paid and buyers receive goods—the gold standard for secure cross-border transactions.

Cost-effective payment backup that replaces cash deposits and guarantees obligations without expecting to be drawn—your safety net for business deals.

Irrevocable bank commitments via MT760 that multiply your financial capacity and serve as cash-equivalent collateral for major transactions.

Bank-backed bonds that prove your ability to deliver on contracts, winning you more tenders and building instant client trust.

Enables you to receive 15-30% upfront payment while protecting your buyer's advance—unlocking immediate cash flow for production.

Same-day bank verification of your financial capacity that fast-tracks negotiations and qualifies you for exclusive opportunities.

Verified restriction of funds in your name that demonstrates commitment and financial capacity without transferring ownership.

Soft Bank confirmation of your financial standing that opens doors to negotiations without creating legal obligations.

The ultimate bank confirmation combines proof of funds with transaction commitment and authority—showing you're serious and ready to close.

Mandatory bid bonds for government and corporate tenders that qualify you to compete for major contracts worth millions.

Other Services

Open secure personal and corporate bank accounts in Dubai through a fully remote eKYC process — no physical presence required.

Access high-yield investment programs and strategic joint venture opportunities designed to grow capital and expand global ventures.

Enhance your business cash flow with flexible loan solutions and invoice financing tailored for importers, exporters, and SMEs.

Empowering importers with extended payment terms and trade credit facilities for purchasing goods from verified Chinese suppliers.

Josephine was an accomplished Corporate Relationship Manager with over 9 years of experience in trade finance, corporate banking, and client portfolio management. She specializes in structuring tailored financial solutions, risk assessment, and building long-term partnerships across local and international markets. With strong analytical skills and a passion for client success, Josephine consistently delivers value through strategic advisory and cross-functional collaboration. Her background also includes lecturing at the tertiary level, highlighting her dedication to knowledge sharing and professional development. She holds a Master’s degree in Management and Administration from the University of Ghana.

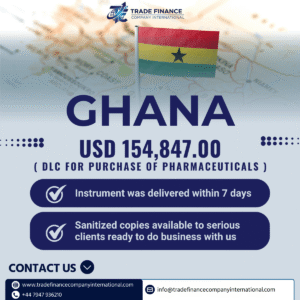

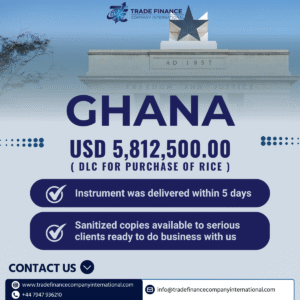

Completed Deals

Community Highlights

Ghana’s economy is rapidly expanding in sectors such as mining, agriculture, and energy. TFCI works closely with local importers, exporters, and contractors to provide financial instruments that help secure deals, improve liquidity, and attract international partnerships.

“Thanks to TFCI’s Proof of Funds and Bank Guarantee, our export project secured funding in record time.”

— Kojo A., Export Manager, Accra

Frequently Asked Questions

Yes, we support both SMEs and large enterprises in issuing and managing letters of credit for import and export activities.

Absolutely. We connect Ghanaian firms with joint venture and foreign investment opportunities.

Yes, all our instruments are issued via global banking networks and authenticated through SWIFT.

Contact Our Ghana Office

Speak with our Ghana trade finance specialists today and discover how we can help your business thrive globally.