Trade Finance Company International – Senegal

Empowering Senegalese Enterprises with Global Financial Instruments

Your trusted gateway to secure international trade, investment, and business growth in West Africa.

Address:

Point E, Rue 6xPE 28 Immeuble Iris, 5th Floor, Dakar, Senegal

Country Manager

Aly Ndiaye | +221 77 557 73 58

Welcome to Our Dakar Office

As one of West Africa’s fastest-developing economies, Senegal plays a strategic role in regional commerce and trade. At TFCI, we provide world-class financial instruments — including letters of credit, bank guarantees, and standby letters of credit (SBLCs) — to help Senegalese companies compete confidently in global markets.

Secure, Trusted, and Globally Accepted

Our Dakar team offers tailor-made financial instruments such as performance bonds, advance payment bonds, proof of funds, and blocked funds to support import-export transactions, infrastructure projects, and private investments.

Trade, Invest, and Grow with Confidence

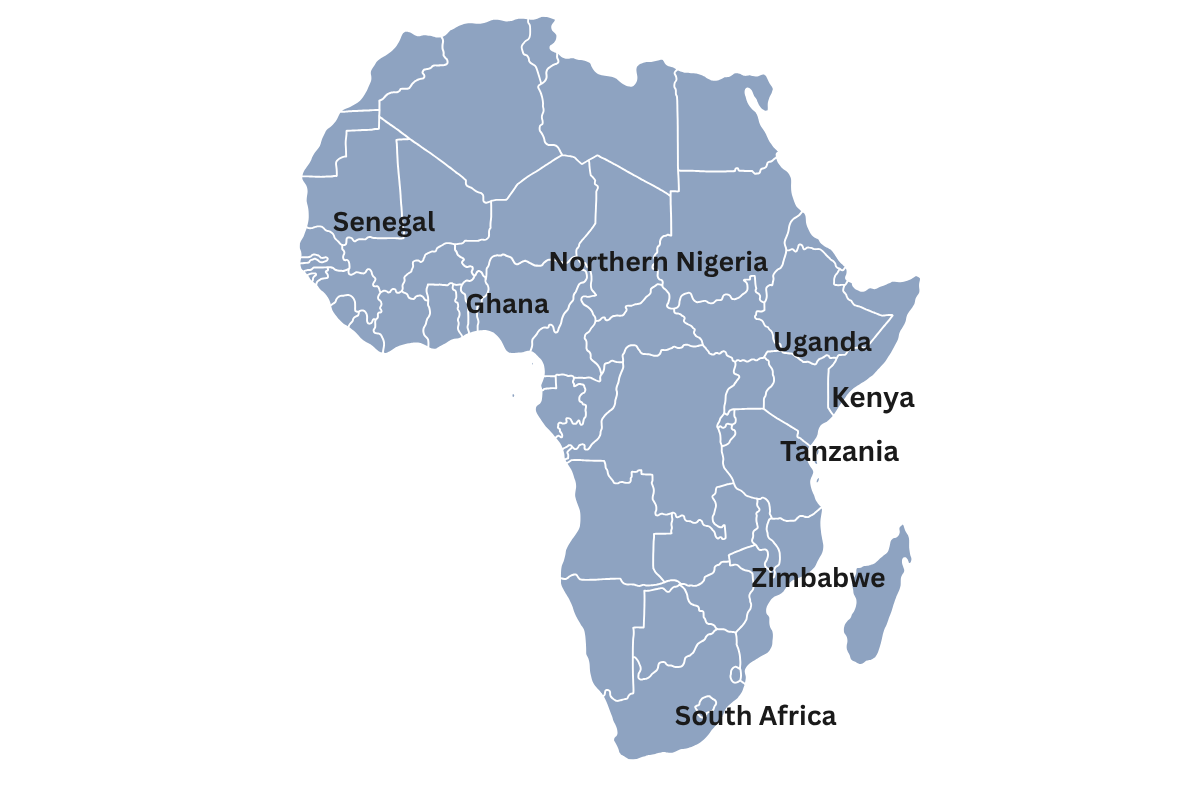

We assist local entrepreneurs and corporations with bank comfort letters, ready willing and able (RWA) letters, and bid bonds for tender participation. Additionally, TFCI provides access to invoice financing, supplier credit, and joint venture opportunities across Africa, Europe, and Asia.

Our List of Services

Bank-guaranteed payment for international trade that ensures sellers get paid and buyers receive goods—the gold standard for secure cross-border transactions.

Cost-effective payment backup that replaces cash deposits and guarantees obligations without expecting to be drawn—your safety net for business deals.

Irrevocable bank commitments via MT760 that multiply your financial capacity and serve as cash-equivalent collateral for major transactions.

Bank-backed bonds that prove your ability to deliver on contracts, winning you more tenders and building instant client trust.

Enables you to receive 15-30% upfront payment while protecting your buyer's advance—unlocking immediate cash flow for production.

Same-day bank verification of your financial capacity that fast-tracks negotiations and qualifies you for exclusive opportunities.

Verified restriction of funds in your name that demonstrates commitment and financial capacity without transferring ownership.

Soft Bank confirmation of your financial standing that opens doors to negotiations without creating legal obligations.

The ultimate bank confirmation combines proof of funds with transaction commitment and authority—showing you're serious and ready to close.

Mandatory bid bonds for government and corporate tenders that qualify you to compete for major contracts worth millions.

Other Services

Open secure personal and corporate bank accounts in Dubai through a fully remote eKYC process — no physical presence required.

Access high-yield investment programs and strategic joint venture opportunities designed to grow capital and expand global ventures.

Enhance your business cash flow with flexible loan solutions and invoice financing tailored for importers, exporters, and SMEs.

Empowering importers with extended payment terms and trade credit facilities for purchasing goods from verified Chinese suppliers.

Community Highlights

Senegal’s expanding trade and infrastructure landscape makes it a key market for international partnerships. TFCI’s financial instruments have supported numerous Senegalese importers and contractors in building lasting global relationships.

“TFCI’s Bank Guarantee allowed us to secure a construction contract with an international client.”

— Mamadou D., Project Director, Dakar

Frequently Asked Questions

Yes, we help SMEs obtain letters of credit and other instruments to facilitate trade.

Yes, all financial instruments are authenticated through international banking networks and SWIFT.

Absolutely. We issue bid bonds, performance bonds, and RWA letters for project participation.